Some years ago, when the Wall Street derivative crisis surfaced, I pointed out that the real culprit was the computer boom. Our government was simply caught asleep while Wall Street created a huge, virtual, gambling-casino, card-house with computers. The multiple leveraging and complexity resulted in a complex maze of indebtedness with essentially no real assets securing the investments.

Some years ago, when the Wall Street derivative crisis surfaced, I pointed out that the real culprit was the computer boom. Our government was simply caught asleep while Wall Street created a huge, virtual, gambling-casino, card-house with computers. The multiple leveraging and complexity resulted in a complex maze of indebtedness with essentially no real assets securing the investments.

~

Essentially, the computer boom once again created a similar complex maze in the mortgage industry. Banks sold mortgages multiple times all through computer transactions. The original documents were lost. Now, banks are unable to foreclose without being able to present those original documents. It has created a 1.4 trillion dollar mess. Homeowners can make a play to legally claim they owe nothing. Courts may well be bound to agree. Legislators may need to step in to avert total chaos.

~

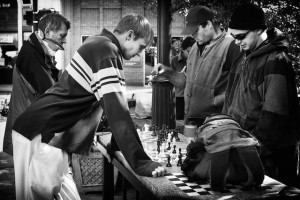

The complexity didn’t stop there. Banks could shuffle around money so quickly within the cyberworld that it became like a shell game. Money could appear and disappear instantly under whatever shell they wanted it to. This is where the money came from for many of those mortgages. Strictly speaking, the banks didn’t even have the money they loaned. It was a big financial shell game.

~

It is yet to be seen what calamities will arise due to the government’s inability (perhaps understandable inability) to keep up with the complexities of the exploding computer world of the financial markets.

~

Big financial companies like Goldman Sachs made fortunes. They started out bankrupting small companies to reap huge financial rewards. For example, selling AIG useless paper. They went on to create such complex financial structures that regulatory agencies were unable to identify deviations from regulations. This enabled them to put companies so far in debt, they were unable to stay afloat. Not satisfied with those millions, the financial industries moved onto nations. For example, Greece, which ended up far more in debt than the International Monetary Fund (IMF) would ever have allowed.

~

George Soros has made billions by destroying currencies. For example, Malaysia and Britain. Some believe he has now moved on to the United States as his next victim. The finesse and complexity of these markets eludes government inspectors. With increased regulations, some of the little guys will be caught. But the big fish will remain unscathed.

~

It is really nothing new for big financial powers to manipulate the market from behind the scenes. The great depression of the 1930’s was created for profit. The good news is that computers are making information readily available to all the people. I look forward to the time when all cards are face up and the financial markets operate in a harmonious and life-supporting manner. This cannot be done through regulation alone. The regulators are simply no smarter than those whom they regulate. Positive global transformation can only come about through elevation of world consciousness. That is our domain. It is our purpose. By watering the root of life, all aspects of life blossom.

This is a good summary of the far-ranging crisis and gets to the heart of the cure. More rules and regs won’t stop the black-hearted, and more rules and regs aren’t needed for those who purify the heart by diving into the Source. May your message gain traction in the mass consciousness !

As an attorney who has represented many homeowners through the foreclosure process, I know this is a story that needs to be told. Most people still hold to the faith that our nation’s wealth and the system that supports it has at least some degree of integrity. However, as recent events have conclusively shown, the financial structure has become corrupted to a degree that it tempts those on “Main Street” to sink to the level of “Wall Street” and ruthlessly game the system, or what’s left of it. By watering the root of life, perhaps a reborn integrity, and hence faith in the system, can begin to be built once again, and form the foundation of a new financial structure that will deeply nourish a new and lasting prosperity for all of us in place of short-sighted greed. Getting a “computer savvy” new regulatory sheriff in town to jail those involved in the criminal conspiracy to separate the innocent from their homes and their savings is part of the solution, but lasting relief is just as you have identified it. Keep up the good work!